What is This About?

Variance Analysis is traditionally regarded as a staple of FP&A but it can be quite versatile. The minimalistic formulas can accommodate different levels of complexity.

One such instance of versatility would be the performance attribution models used in the asset management industry, which I stumbled upon during my preparation for the CFA program.

In this article, we will go through the aforementioned models and see how they can be adapted to FP&A to drive deeper insights and generate value.

Case Study

A case study makes the learning experience easier and more enjoyable to follow.

You can download the case study via the link below:

This time, we follow company X, which would like to analyze its sales for 2022.

Company X would like to compare its current revenues with its forecasts, as well as with its past performance.

Variance Analysis: Visually Explained

Company X starts with traditional variance analysis.

Review

You can refer back to the first article of this Variance Analysis 2.0 series for a quick refresher.

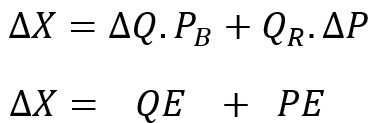

Formula

Here are the formulas for the two usual effects (price and quantity effects):

Figure

The figure below clearly illustrates the decomposition of the total gap into its constituents:

- Quantity effect (QE): the added revenue from purely selling more units;

- Price effect (PE): the added revenue from selling at a higher average price.

Shortcomings

Aside from the few improvements we saw in the previous posts of the Variance Analysis 2.0 series, the regular variance analysis formulas are suitable for any superficial gap analysis work.

However, they fail to capture more subtle nuances of gap analysis:

- Price effect could be further decomposed into pure price effect and interaction between price and quantity effects;

- Quantity effect could be expressed to extract more information from the benchmark.

Performance Attribution Models

The asset management industry has specific needs for performance attribution analysis.

Various tools were developed by scholars and professionals to address these needs.

The performance attribution models we will cover specifically quantify performance relative to a benchmark.

It is analogous to the budget/forecast we use in the variance analysis formulas.

The difference between actual performance (return) versus forecast (benchmark) will be referred to as active return.

It is important to note the following points for the performance attribution models:

- We have a limited budget;

- We invest that limited budget in portfolios with different weights;

- All weights must add up to 100% for each portfolio.

BHB Model

The Brinson, Hood and Beebower (1986) attribution model splits active return into the following components:

- Allocation: the equivalent of the quantity effect in the variance analysis formula;

- Selection: the equivalent to the isolated pure price effect;

- Interaction: the combined interaction effect between quantity and price effects.

Visual Representation

Visually, we can confirm that the selection and interaction effects add up to form the price effect and that the total gap in unaffected relative to the previous variance analysis results:

Sources of Performance

According to the BHB attribution model, the allocation effect can be explained as follows:

- Positive total allocation effect if good decisions outweigh bad decisions;

- Good decisions:

- Overweighting positions with positive benchmark values;

- Underweighting positions with negative benchmark values;

- Bad decisions:

- Overweighting positions with negative benchmark values;

- Underweighting positions with positive benchmark values.

An example of a bad allocation decision would be to over-allocate funds in a portfolio to the tech industry during a period in which it had negative returns

The selection effect is more straightforward to interpret as positive values indicate selection skill.

The interaction effect might be the more subtle one to grasp:

- Positive total interaction effect if good decisions outweigh bad decisions;

- Good decisions:

- Overweighting positions with positive selection effect;

- Underweighting positions with negative selection effect;

- Bad decisions:

- Overweighting positions with negative selection effect;

- Underweighting positions with positive selection effect.

An example of a good selection decision would be to over-allocate funds in a portfolio to the tech industry during a period in which it had negative returns, but earning positive returns because we selectively invested in over-performing tech stocks as opposed to investing in the whole tech industry.

Shortcomings

The BHB attribution model is more comprehensive than the variance analysis formulas but it has one limitation.

It has embedded failure in its allocation effect:

- If all benchmark values are positive

- AND you have a limited budget (constraint)

Then any over-allocation will result in offsetting under-allocation.

Since all benchmark values are positive, all under-allocations will be interpreted as bad decisions.

BF Model

The Brinson & Fachler attribution model is similar to the BHB model.

They only differ in their expression of the allocation effect.

That is why we will cover only the allocation effect for the BF model.

Visual Representation

The visualization of the allocation effect is not as straightforward as for the BHB model but do not worry about it, it will soon make sense:

Sources of Performance

According to the BF attribution model, the allocation effect can be explained as follows:

- Positive total allocation effect if good decisions outweigh bad decisions;

- Good decisions:

- Overweighting positions for which the benchmark outperforms the total benchmark;

- Underweighting positions for which the benchmark underperforms the total benchmark.

- Bad decisions:

- Overweighting positions for which the benchmark underperforms the total benchmark;

- Underweighting positions for which the benchmark outperforms the total benchmark.

Once aggregated, the total allocation effect is the same as in the BHB model, it only differs per position.

That is because all the active weights (differences between actual and benchmark weights) must add up to 0.

The idea is that portfolio managers can now be rewarded for underweighting a stock that was underperforming its benchmark, despite having a positive return.

Absolute Approach Attribution

We will now apply these new models to our case study to complement variance analysis.

The BHB model is intuitive because it is essentially a more detailed version of variance analysis.

It can accommodate absolute values, instead of just weights (unlike the BF model).

Case Study Insights

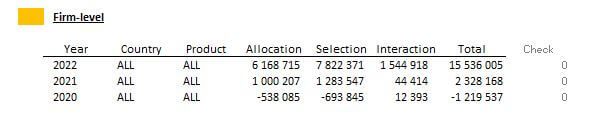

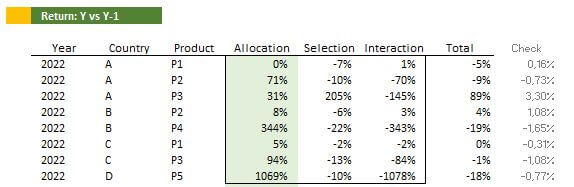

Plugging in the sales numbers (versus last year) in the BHB model yields the following results:

Year 2020 demonstrates that it is possible to have a positive interaction effect despite total allocation and selection effects being negative.

Relative Approach Attribution

We can circumvent the limitations of the BF model (only accepts weights as inputs) by expressing performance on a relative basis.

From Absolute to Relative Performance

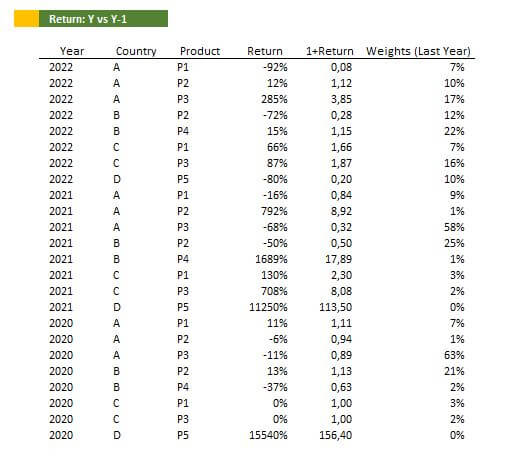

First, we need to express the realized performance in terms of another measure of performance.

It could be the forecast performance or last year’s realized performance.

Each metric is to be transformed into a rate of return.

Weights will be derived from each metric value relative to the total of the metric.

We then plug in the returns into the BHB model to obtain the following results:

Note that if the benchmark used is the forecast metric, then the allocation and interactions effects simplify to zero since we have the same starting weights for actual and forecast values (last year’s ending values).

The active weights are null.

In that case, there is no difference between the BHB and the BF models.

Unleashing the BF Model’s FP&A Potential

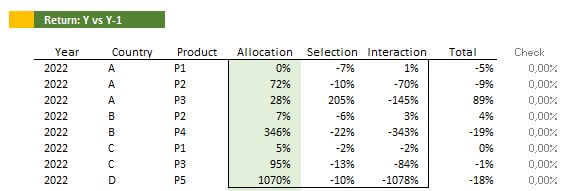

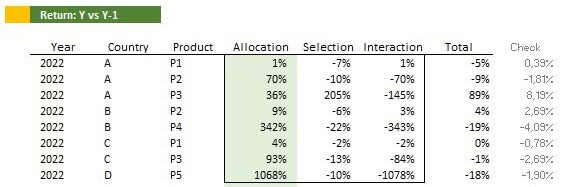

Now that the absolute values have been turned into returns, we can conduct a BF attribution analysis:

Compared to the BHB figure, the result is that:

- Selection and interaction individual effects are unchanged;

- The individual allocation effects have changed;

- The total allocation effect remains unchanged.

Aggregating the three effects (allocation, selection and interaction) for all the segments (Product X in Country Y) gives us the total active return:

It is demonstrated at the granular level in the case study if you wish to see more.

Normative Approach

We can get creative with performance attribution, especially the allocation effect portion.

Challenging the Norm

In the allocation effect of the BF model, instead of evaluating the difference in return between a position’s benchmark return and the total benchmark return, we could use a different total benchmark target.

Normative BF Model

For example, it could be a minimal level of return required from investors.

It could also be a sectorial inflation rate, if we transformed prices into returns.

It could be a competitor’s price increase rate etc.

The resulting aggregated allocation effect would be unchanged.

Simply make sure there is a business rationale behind the norm you are using.

Case Study Insights

By introducing a sectorial inflation rate of 20% as the new norm, the individual allocations effects change but the total allocation effect remains the same.

The Fine Line Between Meaning and Noise

When diving into increasing levels of details, one should not lose sight of the purpose of performance attribution.

For instance, if we are only allocating resources to broad categories, then it is very possible that the returns derived at a more granular level are simply meaningless.

Values will be computed mechanically in all situations, but they are not always the result of intent.

Performance evaluation should be performed at the level where discretionary action meets decision making.

Conclusion

As always, I hope you found this post useful and/or entertaining.

It baffles me how everything seems to be connected once you isolate concepts in their abstract form.

I hope this new perspective on FP&A will lead to higher-quality insights or at least bring about a more holistic appreciation of what relative performance might mean.

This third article concludes the Variance Analysis 2.0 series, which has been quite stimulating to produce.

Complexity truly does arise from the simplest of formulas.

It is up to us to meet this complexity with an unwavering spirit of curiosity.